HOW TO EXPAND TRADING OPPORTUNITIES THROUGH DEFI INDEX ON BINANCE

28/01/2022

By Damilola Ogungbayi

Key points

- What is DeFi

- What are DeFi Index Futures

- What are the benefits of trading DeFi Index Futures

- Why should trade DeFi Index with Binance

- INTRODUCTION TO DEFI

Decentralized finance (DeFi) is an umbrella term for a variety of applications and projects in the public blockchain space geared toward disrupting the traditional finance world.DeFi terminate intermediaries and can cater to users differently, like allowing loans. It is a broad term including many various applications and functionalities. Such applications avoid involving any central bank, regulatory body, or other individual and are totally decentralized and not controlled by any single unit.

- INTRODUCTION TO DEFI INDEX FUTURES

Binance is a prevalent cryptocurrency exchange, and futures trading in it are large scenarios with multiple choices to trade.

Binance Futures trading is a wide landscape with many options to trade.The entire ecosystem has developed, offering new assets to trade with, due to more people that joined the DeFi world via Binance.

DeFi Index Futures are tradable assets offered on Binance platform under USDT-margined perpetual futures product line. To get more clarification,it is essential to understand what an Index is?

An index is basically a tool used to track many assets or an individual asset’s performance. The dimension is taken for imitating the actions of a particular field of the marketplace. Therefore, the DeFi index is made for tracking the entire cryptocurrencies’ DeFi performance accessible on Binance.

Some of the standard DeFi protocols calculated into DeFi index futures comprise

- 0x[ZRX]

- Synthetic Network Token[SNK]

- Swipe[SXP]

- Maker[MKR]

- Kyber Network[KNC]

- Chainlink[LINK]

- Aave[LEND]

- Kava.io[KAVA]

- Compound[COMP]

- Band Protocol[BAND]

- BENEFITS OF TRADING DEFI INDEX FUTURES

There are explicit benefits inherent to DeFi Index Futures which are shown below.

- Performance Measurement

DeFi Index Futures offers traders new information analysis. Since an Index tries to recreate multiple pieces of the market segment,the performance has a new effect on asset allocations.Rather than tracking the performance of just one crypto currency such as Bitcoin, where uncertainty in price action and higher volatility is expected, the presentation of a synthesized index sector offers a less volatile experience.Traders also have a better time targeting investment mandates with DeFi Index Futures than other cryptocurrency trading options.

2. Asset Allocation

Traders can allocate a sizeable portion of their portfolio into Binance’s DeFi Index Futures, rather than holding or investing into a broad portfolio and using multiple contracts to cover a range of assets.

Traders can balance risk by focusing the asset of your portfolio to capture the complete range of investment opportunities of Binance in the DeFi industry.

3. Momentum and Short-term Trading

DeFi Index Futures can represent exciting trading opportunities for short and long-term traders. Traders can capture short-term trends for flexible and reactive strategies. Traders can maximize on relatively small price movements and create profits like any other form of derivatives trading,due to the available of 50x leverage.

4. Diversification or Hedging

Dodging against risk using a USDT DeFi perpetual contract is more efficient than with other hedging alternatives.

When the long-term investors with DeFi tokens use the index as a short hedge to reduce price volatility,they are frequently present local capital efficiency in these perpetual contracts. Traders can also diversify their investments by allocating their capital across the range of DeFi tokens Binance offers.

- HOW TO TRADE DEFI INDEX FUTURES?

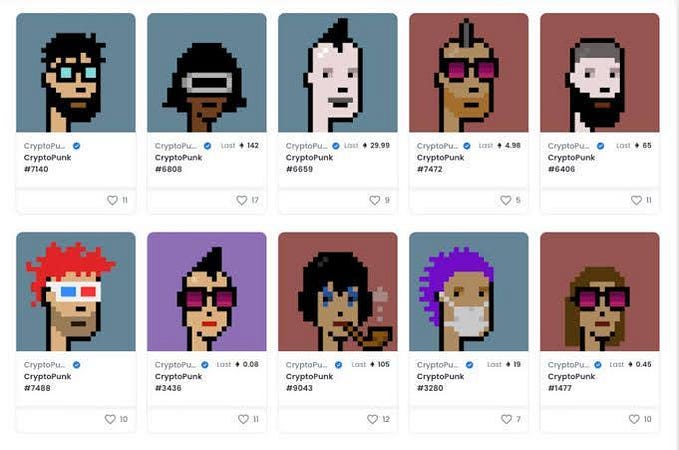

You can start trading DeFi Index Futures by initially locating a reliable exchange. It can support the DeFi projects you believe in and are comfortable with. Binance provides a DeFi Index product that supports approximately ten particular tasks varying and increasing in their own time.

Also, you can begin to trade this kind of asset without panicking about perpetual contracts. These funding rates deviate in rates between the perpetual and index contract markets or settlements because these contracts settled in dollars.

You can also start trading with DeFi Index Futures covering spreads. For instance, you can easily open a short position over a whole DeFi index; however, simultaneously can open a perpetual, long contract for a separate DeFi asset.

As long as you are using USDT for opening and settling your positions. You can trade the index plus the projects comprised in it together with each other.

This is amazing for you as a trader in the DeFi industry. If you anticipate one asset or project to perform worse or better compared to other index projects. The skill to evade against a portion of an index can eventually enable a perfect portfolio performance.

- WHY SHOULD WE TRADE DEFI INDEX ON BINANCE

- Binance’s world-class matching engine supports up to 1,400,000 orders per second. This ensures that your crypto trading experience is quick and reliable.

- Binance Futures provide a generously wide range of leverage for accounts with a balance of $0 to $50,000 so that every trader can their portfolio no matter their account balance.

- Binance Futures has become one of the most liquid derivatives exchanges in the market.thanks to its enormous selection of trading pairs.Traders can always expect their buy and sell orders to get filled promptly without having to worry about slippage.

- Binance Futures has an exceptional low fee structure.The fees of the maker/taker can go as low as 0.000%/0.017% allowing traders to keep their profits.

- Binance Futures provides the ability to make profits regardless of the market’s direction.With Binance Futures,traders can sell high and buy low or buy low and sell high to benefit from any price fluctuation while implementing different strategies.

- Binance Futures offers a huge selection of cryptos.There are more than 530 crypto-to-crypto trading pairs,enabling users to trade anything from DeFi to memecoins.

- Binance is the world’s most liquid cryptocurrency exchange, with the biggest volumes across multiple crypto pairs.Binance has built a strong reputation over the years with more than 28.6 million active users.

- Binance has built one of the most secure trading platforms in the world where users can enjoy different features like KYC,2FA and Anti-Phishing code,to protect themselves against criminal actors.

- Binance offers support in 17 different languages with an easy-to-use user interface to ensure that any trader from anywhere in the world can participate in the crypto revolution.

- Millions of global crypto users trust Binance.Binance multi-tier & multi-cluster system architecture and SAFU (Secure Assets Fund for Users) insurance fund protect your account.

CONCLUSION

Despite the fact that it is important to in mind all the basics. DeFi Index Futures can give more efficiency and stability to a trader,due to coverage over a whole market sector, derivatives trading are still very risky form. Always consider the ratio of risk/reward in any Futures trading asset before proceeding to trade.

To learn more and get started with Binance DeFi futures click the below.

https://www.binance.com/en/blog/futures/how-to-expand-your-t

rading-opportunities-with-defi-index-futures-42149982468490

3078?ref=331234001